Why Did So Many Countries Join the Gold Standard?

Since it's the 50th anniversary of the end of Bretton Woods on 15th, I’m writing a multi-part series on the history of international monetary regimes.

Global monetary history is interesting because it involves countries going on some commodity standard (gold, silver or even a combined bimetallic standard) and then going off it when times are bad. Then, when economic conditions get better they try to reinstate the commodity standard (usually gold the second time around), but run into various problems.

Bimetallism

Why did they use gold? The answer is that most countries started off with a bimetallic standard but then transitioned to a gold standard. A bimetallic standard is when you let two metals be used as currency in your country. The problem with this is that you have to get the ratio of these metals right, or else your country will have an unstable currency. A good example of this is France.

In 1803 France passed a law guaranteeing the conversion of silver and gold to money at a 15.5:1 ratio. Which meant that you could exchange 1 unit of gold for the same amount of money as 15.5 units of silver. This worked for as long as the market price of silver and gold remained in the ratio of 15.5:1.

But if the mint ratio was misaligned (if silver or gold had a different market price), one of the metals would go out of circulation. For example, in the 1800s after the French law was passed, the relative price of gold increased and gold was less used in transactions. But in the 1840s and 50s when the gold rush in California and Australia reduced the price of gold, the silver:gold price ratio became higher than what the mint was willing to exchange it at. People hoarded silver and used gold as the medium of exchange. So, gold became more popular in France as a medium of exchange.

The opposite happened with the discovery of silver deposits in Nevada in 1859. The relative market price of silver fell and gold increased compared to the mint ratio, and silver was being used in circulation rather than gold. In the end, France switched to gold in the 1870s.

In England, this problem was inadvertently solved by Issac Newton. Besides being a brilliant physicist, Newton was also the Master of the Royal Mint from 1699 to 1727. In 1717, he fixed the ratio of silver and gold such that the relative price of silver was high, and the relative price of gold was lower than the market price. So, people hoarded silver and used gold for their transactions in Britain. By design or not, Newton created the modern world’s first gold standard. As Britain became the premier economic power, it became advantageous for countries to switch to the gold standard.

The Dominoes Fall

Why would they want to switch to the gold standard? If you trade with a country on the gold standard, it’s more advantageous for your own currency to be on the gold standard. That would make trading relationships stronger because you would not have the trouble of exchange rate instability. An example comes from a paper written by Christopher Meissner where he says that American exporters and importers wanted the gold standard because Britain was on it too, and a common standard of value would mean that they wouldn’t need to spend money on broker’s fees on exchanging sterling and hedging sterling risk.

In France, a majority of the support for the gold standard came from merchants who traded with England. But merchants in the south and east of France preferred a silver regime because they traded with silver regime countries like the various German states, Russia and countries in Asia.

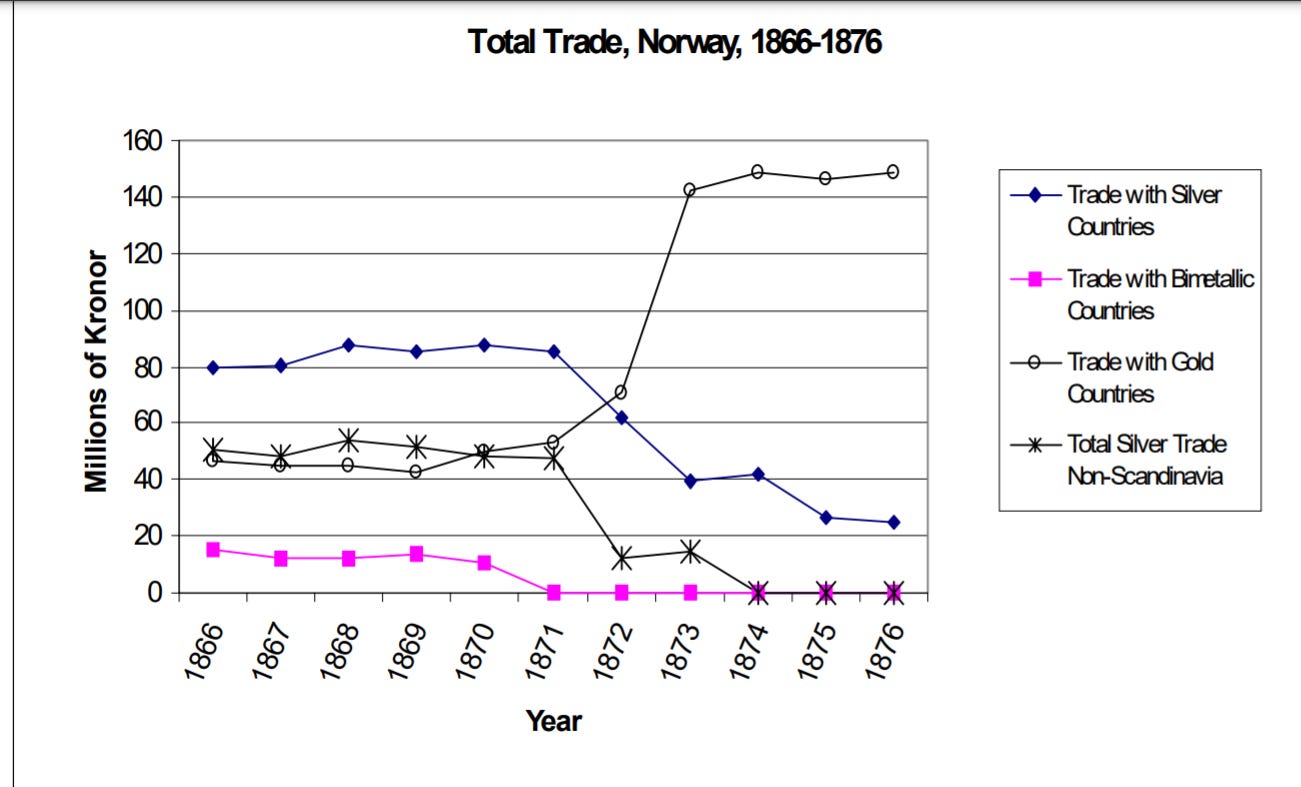

This suggests that being on the gold standard had network effects. You went on the gold standard because your trading partners did, and they did because their trading partners did too. And so, it became something countries were forced to do just to make trade easier. The evidence for this is strong. The first few countries to switch were Australia, Canada and Portugal. Then came Germany in 1872 which had recently unified, won the Franco-Prussian war (which made it easier to acquire gold) , and restarted its monetary system by backing its currency with gold. Then came its trading partners Norway, Sweden and Denmark which too were forced to switch because their trade with gold standard countries had increased massively.

From Mitchell (1992) International Historical Statistics Europe 1750–1988 via Meissner (2002) A New World Order: Explaining the Emergence of the Classical Gold Standard

Then came France, Switzerland and Belgium in 1878, and the US had already done so in 1873. For most of the developed world, they had transitioned by the sheer power of network effects.

The best evidence in this comes from the previously mentioned paper A New World Order: Explaining the Emergence of the Classical Gold Standard by Christopher Meissner (link here). Meissner shows that the adoption of the gold standard was driven mostly by network effects for countries with stable financial systems.

Some hiccups

One of the main motives for governments to start on the gold standard was to prevent inflation. This was because gold supplies are limited (the World Gold Council estimates a 1.5% growth rate in 2019). For countries that already were on some other commodity standard in 1870 the median date of gold adoption was 1875, but for countries that were on paper money (fiat currency), their median date of adoption was 1896 - almost 21 years later.

This was because they typically had higher rates of money growth and if they were on the gold standard, their money supply could not keep up with gold reserves. The second reason is that their gold standards would not have been credible - investors and speculators would not have believed that they actually had the amount of gold they said they did. So, they took time to establish their credibility that they would not have excessive money growth or fiscal deficits.

Another major problem was that going on a gold standard would make lenders better off compared to debtors. Gold was inherently deflationary due to its limited supply, and so the revenues of debtors would fall, but if they had borrowed money - its value was fixed. In the US where rural interests had large debts this led to political opposition to the gold standard culminating in William Jennings Bryan’s famous Cross of Gold Speech in 1896. But evidence for this is shaky with studies not finding any correlation between debt values and vote for Jennings.

Finally, another reason countries went on it was that they wanted lower borrowing costs. If bondowners knew they’d get paid in a currency that was backed by gold (and gold was accepted elsewhere), they’d charge lower interest rates compared to fiat currencies which could be devalued. The actual empirical effect for this is between 125 and 140 basis points.

After joining the Gold Standard

To begin with, many of the countries that did join the Gold Standard weren’t actually on the Gold Standard. Some actually had gold coins and gold bullion in circulation, but others had paper money backed by foreign currency. In the next post I’ll show what joining the gold standard actually did. It was a period of growth, currency stability and low inflation for many of the countries that joined it. But it did come with significant costs in the periods after World War One. I’ll explore all of this in the next post!

References

Globalizing Capital by Barry Eichengreen

A New World Order: Explaining the Emergence of the Classical Gold Standard by Christopher Meissner

Monetary Populism in Nineteenth Century America: An Open Economy Interpretation by Jeffery Frieden