The Fed is everyone's central banker

It has been an unusual few weeks. People have lost their jobs, markets have crashed, and there has bizarrely been a shortage of US dollars in the rest of the world.

Last month, the Federal Reserve reactivated a financial crisis-era program that let it ensure dollars flow around the global markets. This is a sign that the world’s most powerful central bank knows that the impact of the coronavirus hasn’t been just on the health of people.

How we got here

If you haven’t been living under a rock (or in a reality TV show where you were locked away from everyone else), you probably know that the world is facing a pandemic right now. Coronavirus aka COVID-19 has infected over a million people and killed over 50 thousand since it began. Borders have closed and supply chains have been devastated.

This has had a devastating impact on trade financing, and the flow of US dollars. Most sales in the global trade system are denominated in US dollars. Even if there are two companies who both are not in the US, they probably will use the US dollar as the medium of exchange. *

Right now, supply lines have lost critical components in Europe, South East Asia, Japan, the United States and China. When someone cancels an order or doesn’t make a payment in a supply chain, this has ripple effects on everyone in the supply chain.

Or in the words of a Wall Street analyst

Every supply chain is a payment chain in reverse

- Zoltan Pozsar

When some companies cancel orders in the supply chain, everyone from the manufacturers to the miners is affected. They lose revenues.

But just because they have lost revenue, doesn’t mean that they don’t have to pay their bills. Some companies may have debt to pay (in US dollars) or contractual obligations to fulfill (in US dollars again) and they don’t have that money.

They may have money in the local currency, but they won’t have enough US dollars to lend. **

Where do they get the money from?

They go to their banks and ask for a US dollar loan. Not all international banks have that, and those who do don’t necessarily have enough to give everyone who wants it.

So they go their central bank and ask for US dollars. Several central banks have had reserves in foreign currencies for this exact moment. They had been saving up just for this.

But I’ve played a small trick with words in this.

The central banks don’t have US dollars, they have US government bonds. And they need to sell those bonds to get cash.

Cash is to a business as oxygen is to an individual - never thought about when it is present; only thought about when it is absent. When bills come due only cash is legal tender. Never leave home without it.

-Warren Buffett

And the selling began…

I have never seen anything like this in 35 years of trading

-Tom di Galoma, managing director of Treasurys trading at Seaport Global Securities. Source

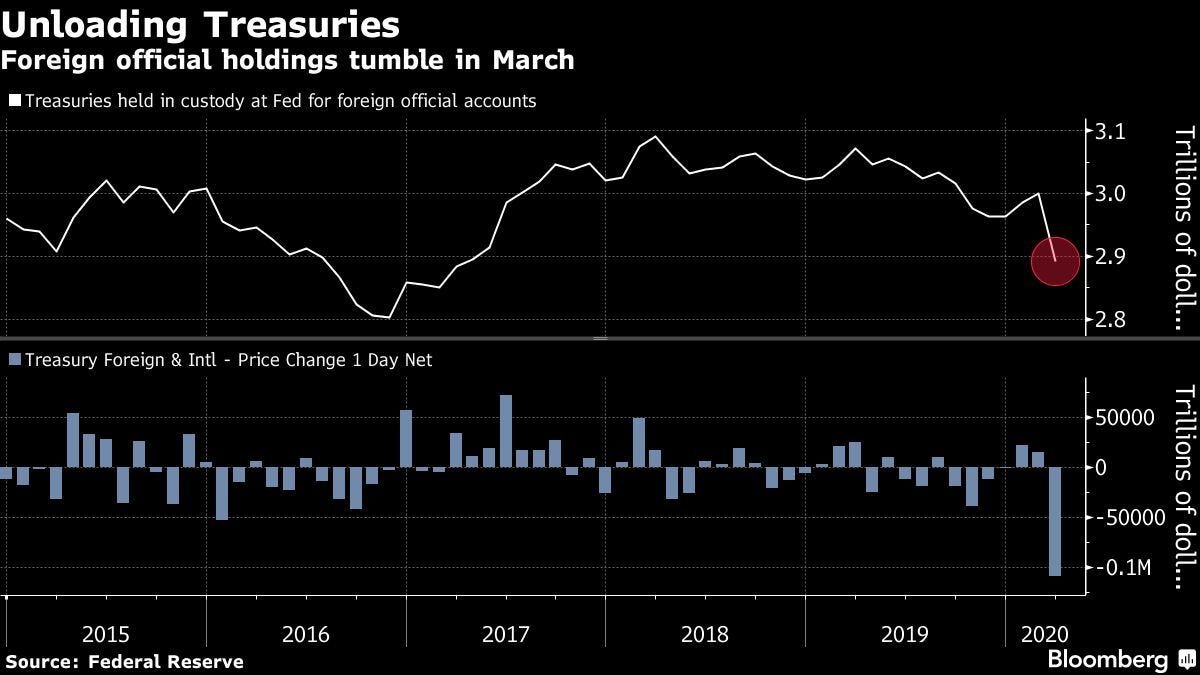

Foreign central banks sold close to a 100 billion dollars in US government bonds (also called Treasury bonds). Those Treasuries didn’t have too many buyers because they were illiquid, and different from the normal securities traded in the market. (See this for an understanding of it).

So the Fed was naturally concerned. The market for what was supposed to be the most safe asset in the world, was not functioning properly.

Solving the problem

The Fed (or more specifically the FOMC) saw that the solution was to ensure that foreign central banks got the cash, without liquidating US dollar assets. The best way to do that was to exchange dollars with them, in exchange for their currency. A few months later, they give the dollars back and the Fed gives the foreign currency back to the central bank. This is called a central bank swap line.

Imagine this as an example:

Fed gives $100 to the Bank of Japan (Japan’s central bank) at today’s exchange rate of 108 Yen a dollar. That is 10800 Yen.

The Bank of Japan lends that $100 to banks in Japan so they can fulfill their dollar needs.

3 months later those banks give the $100 back to the Bank of Japan.

Then the Bank of Japan and the Fed exchange the ¥10800 back at the same price of ¥108/ per US$. The BOJ gets its Yen back, and the Fed gets its dollars back, and everyone is happy.

But this isn’t the only way they can solve the problem. Remember all the treasuries the foreign central banks have? The Fed can give a loan in US$ with those treasuries as collateral.

If the Reserve Bank of India has $100 of treasuries at the Federal Reserve, its not in the interest of either of them to sell them at lower prices right away. The RBI doesn’t want a forced sale of the securities which will reduce the money it gets for its instruments and the Fed doesn’t want the forced selling because it destabilizes the treasury markets.

The RBI sells its Treasuries to the Fed (which can buy an infinite number of them in theory), and the RBI agrees to repurchase it a few months later.

Imagine this as an example:

The RBI holds $100 in Treasuries at an account in the Fed. They don’t want to sell in the market because the large scale selling will cause them to get a lower price.

The Fed doesn’t want them to sell as it causes market instability. Both the RBI and the Fed work out a deal.

The Fed buys the bonds from the RBI, and the RBI gets the dollars.

The RBI lends to its underlying banks who then lend it to their customers who need dollars.

A few months later the banks get the dollars back, give it back to the RBI and the RBI buys the Treasury bonds back from the Fed.

And they live happily ever after…

What happens after this?

We don’t know exactly but it does seem like a happily ever after scenario. For the time being, lending against the world’s safest asset - US Treasury bonds is a good idea. But it can’t go on for ever. At some point, the world will realize that it isn’t possible to run on something they don’t have control. Maybe that is when the Fed raises rates in the future, or when China gets the world to use the yuan as the reserve currency.

But for the moment the Dollar is God, and Jerome Powell is his Prophet.

——————————————————————————————————————

*Why? It is one of the only currencies everyone accepts. If I pay you in South African Rand, what will you do with it? But if I paid you in US dollars you could spend it immediately. Its a self fulfilling prophecy. If everyone believes that the US dollar is the global medium of exchange, everyone uses it. See Gopinathan (2015) for more on this.

**Why don’t they just convert their currency to dollars? Good question. The answer is that it costs a lot to do so now. Most of the emerging market currencies (like India, Indonesia, South Africa) have fallen a lot in this year and companies there may not have enough money in US$. And loans offer an obvious but sometimes forgotten advantage. You get money which isn’t yours, and so you can stay solvent for longer. Also companies may want to take small loans just so that they have cash for the future.

The foreign exchange markets are showing signs of stress too from banks converting foreign exchange but that is a story for another day. It isn’t easy to convert money right now. See: https://www.ft.com/content/5f8237cf-0e90-4f7d-9a0d-e4430f6fc7a1