How to break a peg

On 8th July, it was reported that US President Donald Trump was thinking about ending Hong Kong’s currency peg to the US Dollar. The proposal was shelved , but its worth thinking why Hong Kong has a different monetary system than the rest of the world.

Trust: the oldest problem in finance

A theme of this newsletter is that the lack of trust is a difficult problem to solve in finance. Another theme is that the dominance of the US Dollar is an extremely important force in the world economy. This post combines both of them.

If you are a small country with no resources, you will have a hard time. To begin with, you need to find a way to earn a living. You need to ensure that your people have jobs, houses, and grow rich. Part of this development process is having a stable currency to work with.

If you’re a young country with no track record, selling your currency to the rest of the world is really hard. They don’t know how your economy will do, whether they can spend your currency in your country, whether your currency will be devalued and so on. This is a problem because without a stable value for the country’s currency, economic activity reduces because people don’t feel confident spending in it.

And so, there are many workarounds to this. Some countries which experience hyper-inflation give up their currency and they just end up using US Dollars instead. Some countries just issue their currency and let it float on the international market.

But some countries do a hybrid of those two approaches. They issue their own currency, but then decide to fix the value of their currency with respect to another currency. This is what Hong Kong did in 1983.

The world in 1983 was a very different place. China was still in the process of opening up to the West and was not the economic powerhouse it is today. Investors were still sceptical about the economy, and their property rights in China.

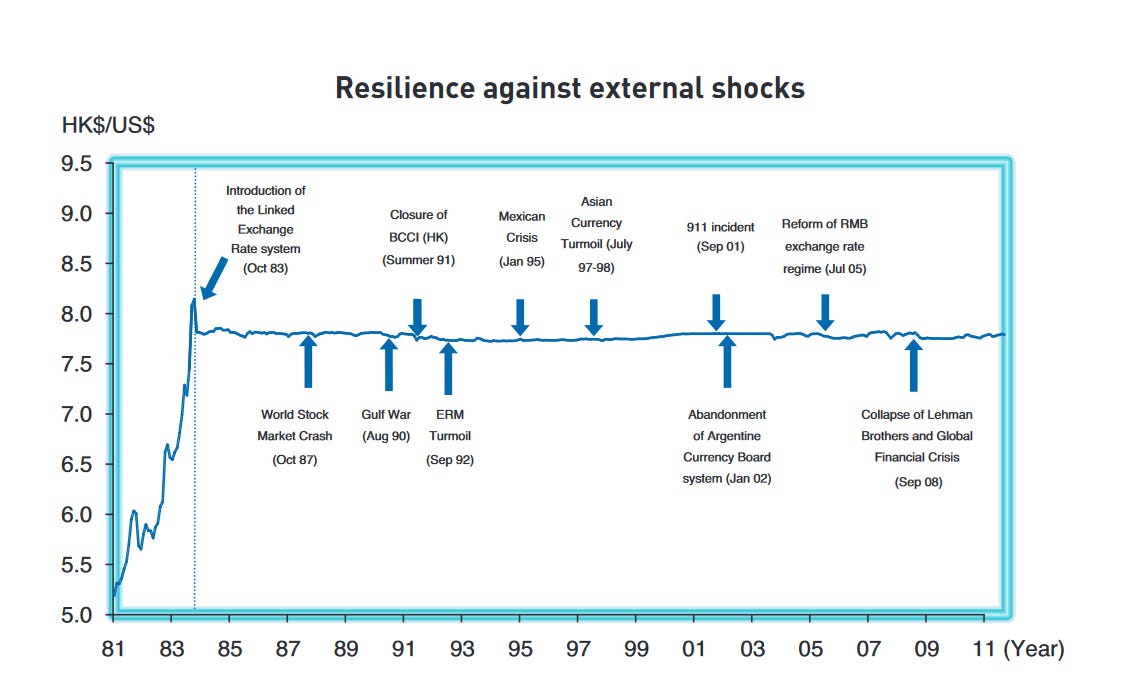

So when talks were going on between the British and Chinese about the handover of Hong Kong, investors panicked. They were worried that Hong Kong would lose its place as a financial and then a manufacturing hub. In expectation that Hong Kong would be transformed to a Chinese-like socialist city, they sold Hong Kong’s currency en masse and it fell nearly 33% from HK$6 per USD in January 1983 to nearly HK$8 per USD in October 1983.

Source: HKMA

Hong Kong’s central bank, the HKMA decided to step in and guarantee the value of Hong Kong’s currency at HK$7.8 a US Dollar. They did this to inspire confidence in the markets, that come what may, the value of the Hong Kong Dollar was going to be guaranteed at $7.8 a dollar.

Today the currency band has changed from HK$7.8/USD to being allowed to trade anywhere between HK$7.75 and HK$ 7.85 per US Dollar.

How does this work?

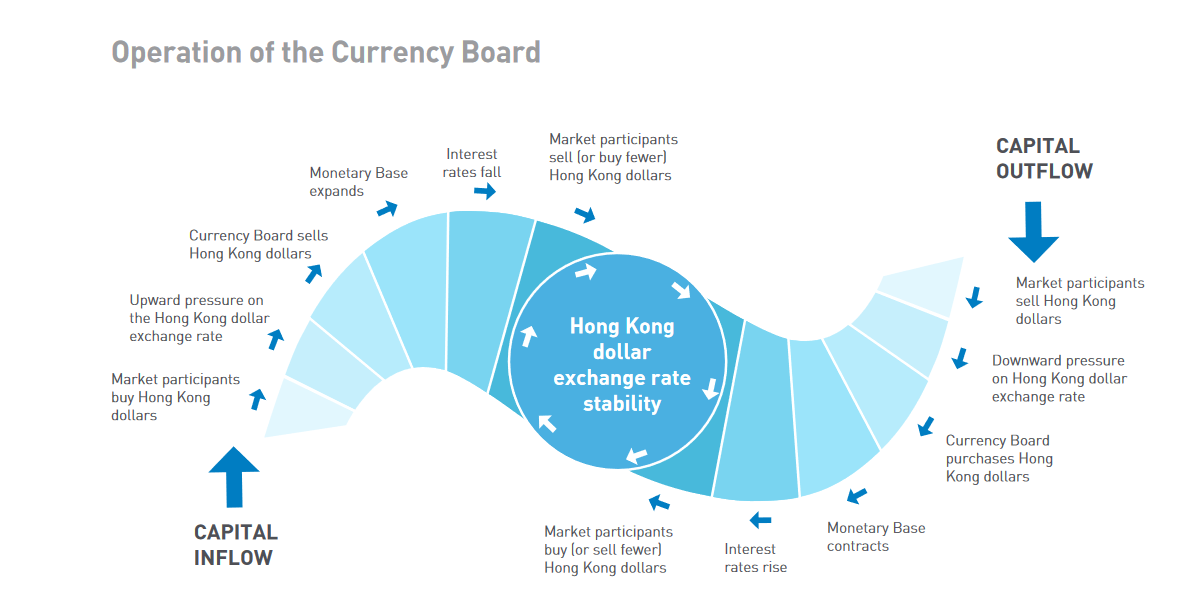

Here is a graphic from the HKMA showing how it works.

Let us imagine that the HK Dollar appreciates to $7.75/USD because lots of people are buying HKD. That means that the HKMA has to sell HKD to reduce its price, and will buy US Dollars in the market.

When the HKMA sells HKD, the supply of HKD increases. When that happens, the interest rate in Hong Kong falls because more people are willing to lend money in HKD.

But when the HKD falls against the US Dollar to $7.85/USD, the HKMA has to do the opposite. It has to buy HKD, and sell US Dollars in the open market.

This means that the supply of HKD reduces, and so fewer banks lend on the open market. When that happens the interest rate in Hong Kong increases.

What’s the catch?

While this may sound like a good plan in theory there are two problems with this

You have no control of your interest rate. As you read in the previous section, the interest rate depends on the capital inflows and outflows, which in turn depend on the interest rate abroad. If investors can get a better interest rate abroad, they will leave your country, and you will have to raise interest rates to keep money in your country.

Hong Kong faced this during the Asian Financial crisis in 1997. During the time, there was significant risk aversion towards Asian countries. Investors did not want to put their money in Hong Kong. So the HKMA had to raise interest rates to almost 10% higher than the LIBOR rate to convince investors to put their money in Hong Kong.

You need to have enough of the foreign currency you peg your currency against. This is a problem faced by several countries. During the Asian Financial Crisis, several countries did not have US Dollars and so faced problems in maintaining their peg to the Dollar. So, they couldn’t maintain the peg and the value of their currency declined.

This in essence was the idea behind trying to break Hong Kong’s peg. Hong Kong needs US Dollars to sell to ensure its can maintain the fixed exchange rate. But the thing that the people who designed the plan missed was that Hong Kong’s US Dollar reserves are 3 times the amount of moneyin Hong Kong dollars. This means that Hong Kong has enough money to defend three fixed exchange rates and still have some money left over.

So, to conclude, the proposal was short sighted because it did not account for the fact that Hong Kong had far more money than it needed, and restricting the amount of US Dollars would not change anything for Hong Kong